Mastering the Art of Setting Bookkeeping Rates in 2024

Picture this: You’ve just started your own bookkeeping business, and you’re excited to help small companies manage their financial statements and track their growth. But there’s one question that keeps nagging at you: How much should you charge for your services? Determining the right price for bookkeeping can be a daunting task, but fear not!

How does it look currently?

Bookkeeping rates can vary widely depending on several factors including geographical location, the complexity of the books, the experience level of the bookkeeper, and whether the service is offered by an individual or a firm.

Here are some general pricing structures that bookkeepers may use:

- Hourly Rate: Bookkeepers may charge an hourly rate, which can range from $20 to $100+ per hour, depending on their experience and your region.

- Flat Fee: Some bookkeepers offer flat fees for certain services, like monthly bookkeeping for small businesses. These can range from $150 to $1,000+ per month.

- Per Transaction: Charging per transaction is less common but can be an option for businesses with a very high volume of transactions.

- Project-Based: If you have a specific project, like setting up a new accounting system, bookkeepers might charge a flat project fee.

- Retainer: Some bookkeepers work on a retainer basis where you pay a set amount each month for a predetermined set of services.

Setting the right price for your bookkeeping services is crucial for the success of your business. It not only ensures that you are compensated fairly for your time and expertise but also attracts clients who value your work. Those whoo are starting new bookkeeping services are curious to know how to price bookkeeping service before, also how much others are charhing.

We’ll dive into various factors to consider when determining how much to charge, such as the complexity of the job, industry standards, and your level of experience. By the end of this post, you’ll have a clear idea of how to set competitive rates that reflect your skills and provide value to both you and your clients.

Deciphering Bookkeeping Charges

Factors Influencing Bookkeeping Rates

Bookkeeping rates are influenced by various factors that businesses should consider when determining how much to charge for bookkeeping services. Two key factors include the complexity of financial records and the volume of bookkeeping tasks. The more complex the financial records, such as multiple revenue streams or intricate expense categories, the higher the bookkeeping rates may be. Similarly, if a business has a high volume of bookkeeping tasks, such as numerous transactions to record and reconcile, it can impact the overall cost.

Another important factor in determining bookkeeping rates is the time spent on bookkeeping tasks. Whether it is done by part-time or full-time bookkeepers, accurately tracking time is crucial for calculating charges. Part-time bookkeepers may charge an hourly rate based on the actual hours worked each month, while full-time bookkeepers may have a fixed monthly fee regardless of hours worked.

Outsourced bookkeeping services have gained popularity due to their cost-effective solutions for businesses. By outsourcing their bookkeeping needs, companies eliminate the need for hiring and managing in-house bookkeepers. This can result in significant savings as businesses only pay for the services they require without additional overhead costs like benefits or office space.

The use of specialized software like QuickBooks can also impact bookkeeping rates. Such software streamlines processes and reduces the time required for certain tasks, resulting in potentially lower charges compared to manual methods.

Location of Bookkeeping Firm

Location plays a role in determining bookkeeping rates due to regional differences in living costs and market demand. For example, urban areas with higher living expenses may have higher rates than rural areas with lower costs of living.

Accounting, Bookkeeping Certifications

Certifications held by a bookkeeper can also influence fees charged for their services. Certified Public Accountants (CPAs) or Certified Bookkeepers often command higher rates due to their advanced knowledge and expertise in accounting principles and practices.

Degrees in accounting or finance, or certifications like the Certified Bookkeeper (CB) designation from the American Institute of Professional Bookkeepers or the Certified Public Bookkeeper (CPB) from the National Association of Certified Public Bookkeepers NACPB), may help you charge more.

Local regulations can also impact pricing. Some regions may have specific requirements or compliance standards that bookkeepers must adhere to, which can affect the cost of their services.

Education Level

Education level can also influence pricing in the bookkeeping industry. Bookkeepers with higher levels of education, such as bachelor’s degrees or advanced certifications, may command higher rates due to their enhanced understanding of accounting principles and broader skill set.

Bookkeeping and Accounting Experience

Experience is a significant factor in determining bookkeeping rates. Bookkeepers with extensive experience in the field often charge higher fees due to their expertise and ability to handle complex financial records effectively. Their knowledge of industry-specific regulations and best practices adds value to their services.

Hiring an experienced bookkeeper is essential for businesses seeking accurate financial records.

Types of Bookkeeping Services Provided

The types of bookkeeping services provided can also affect the rates charged. Some bookkeepers may offer basic services like recording transactions and reconciling accounts, while others may provide more comprehensive services such as financial analysis and budgeting. The complexity and depth of the services required can impact the overall cost of bookkeeping.

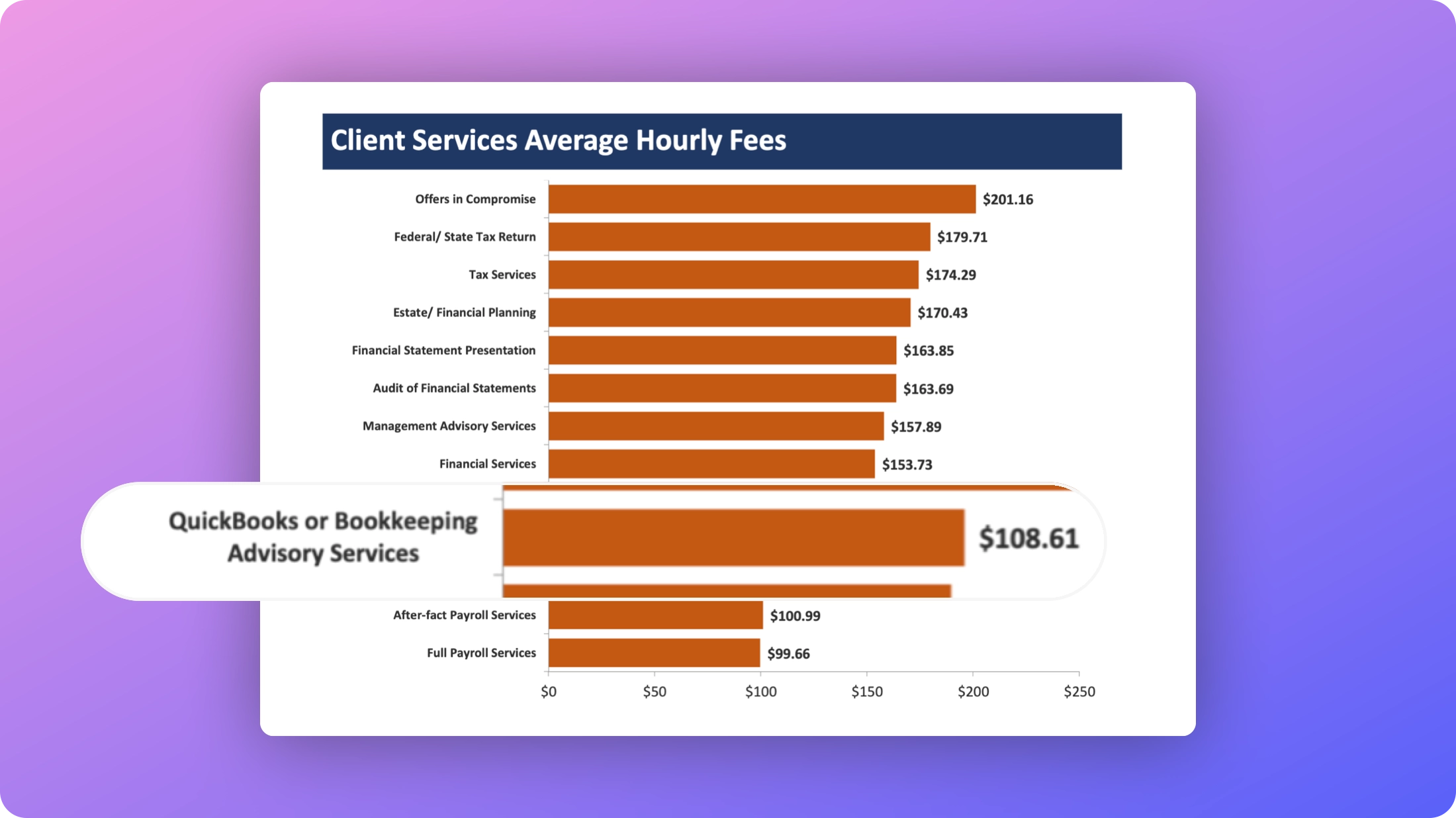

Reference: 2020-2021 Income and Fees of Accountants and Tax Preparers in Public Practice Survey Report (NSA)

There are different types that a bookkeeping firm can offer.

- Some bookkeepers offer basic services that involve recording transactions and reconciling accounts. This means they will keep track of all the money coming in and going out of your business, making sure everything is balanced and accurate.

- On the other hand, there are bookkeepers who go beyond the basics and provide more comprehensive services. These services can include financial analysis and budgeting. Financial analysis involves looking at your business’s financial data and providing insights and recommendations on how to improve your financial performance.

- Budgeting, on the other hand, involves creating a plan for how you will allocate your resources in the future. These more advanced services require additional expertise and time, so they may be priced higher than basic bookkeeping services. The complexity and depth of the services you require will have an impact on the overall cost of bookkeeping.

Setting Your Bookkeeping Rates

Understanding Client Needs

Understanding the specific needs of each client is crucial for determining the appropriate bookkeeping services to offer. Different clients, such as small businesses or large corporations, may have varying requirements and responsibilities. Offering a range of services, including invoicing, reporting, and outsourcing, can help meet the diverse needs of different clients. Having expertise and experience in the bookkeeping field enables professionals to provide tailored solutions that benefit businesses and help them succeed.

Small vs Medium vs Large Clients

Client size plays a significant role. Small clients with fewer financial transactions may require less time and effort compared to medium or large clients with more complex financial records. Tailoring services based on the specific needs of small, medium, or large clients allows for fair pricing that aligns with the level of work required. Larger volumes of clients can lead to economies of scale and potentially lower rates due to increased efficiency.

Basic vs Full-Service Accounting Needs

Differentiating between basic and full-service accounting requirements is essential when determining bookkeeping rates. Basic bookkeeping tasks primarily involve recording income and expenses accurately while maintaining financial records. On the other hand, full-service accounting encompasses more comprehensive tasks such as financial analysis, tax preparation, and payroll management. The complexity involved in providing full-service accounting solutions often warrants higher rates due to additional expertise required.

Pricing Structures

Bookkeepers employ various pricing structures for their services based on factors like industry standards, market demand, and their own business models. When determining prices for bookkeeping services, it’s important to consider factors such as the scope of work involved (hourly rate versus fixed fee), experience level of the bookkeeper or firm (senior-level versus junior-level), location (geographical variations in cost of living), and value-added services provided (consulting or advisory roles). By carefully considering these factors, bookkeepers can establish fair and competitive pricing structures.

Per Transaction vs Percentage of Income

Per transaction pricing models charge a fixed rate for each financial transaction recorded or managed by the bookkeeper. This model is suitable for businesses with a relatively low volume of transactions. On the other hand, percentage-based pricing structures calculate fees based on a percentage of the client’s income or revenue. This model is often used for businesses with higher transaction volumes or those that require more comprehensive financial management services. Choosing the most suitable pricing model depends on the specific needs and circumstances of each business.

Regular Pricing vs Tiered Pricing

Regular pricing involves charging a fixed rate for bookkeeping services on an ongoing basis, typically monthly or quarterly.

Regular pricing is a pretty straightforward way of charging for bookkeeping services. It’s like having a set price that stays the same every month or every three months. So, let’s say you hire a bookkeeper to help you keep track of your finances. With regular pricing, they might charge you, let’s say, $200 per month or $600 per quarter. This means that no matter how much work they have to do or how many hours they spend on your books, the price is always going to be the same. It’s kind of like a subscription, where you pay a fixed amount every month or quarter to get the bookkeeping services you need. This can be really helpful if you have a good idea of how much work your bookkeeper will need to do each month and you want to have a predictable expense. You don’t have to worry about any surprises or unexpected charges because the price is set in stone. It’s also nice because it gives you a clear idea of what your bookkeeping costs will be each month, so you can budget accordingly.

Tiered Pricing for Bookkeeping services

Tiered pricing is a bit different from regular pricing. Instead of charging a fixed rate every month or quarter, the price is based on different levels or tiers. Each tier offers a different set of services and has a corresponding price. So, let’s say you start with the basic tier, which might cost $100 per month. This tier includes basic bookkeeping tasks like recording transactions and reconciling accounts. If you need more advanced services like financial analysis or tax preparation, you can upgrade to a higher tier, which might cost $200 per month. The great thing about tiered pricing is that you can choose the level of service that best fits your needs and budget. If you only need basic bookkeeping, you can save money by sticking to the lower tier. But if you need more comprehensive services, you can opt for a higher tier. It gives you flexibility and allows you to customize your bookkeeping services based on what you require.

The Business of Bookkeeping

Let’s go back to the basics of how business bookkeeping works and why companies outsource their bookkeeping activity.

The business of bookkeeping involves providing bookkeeping services to businesses. Bookkeepers are responsible for regular bookkeeping tasks, such as maintaining financial records and using accounting software like QuickBooks. They play a crucial role in ensuring that a company’s financial transactions are accurately recorded and organized.

Outsourced bookkeeping can be a cost-effective solution for businesses that don’t have the resources or time to handle bookkeeping in-house. By outsourcing their bookkeeping tasks, companies can focus on their core operations while leaving the financial management to professionals. This can save them time, money, and potential headaches associated with handling complex financial matters.

There are several factors to consider. Hiring a professional bookkeeper has its advantages, including expertise in managing financial records and ensuring compliance with tax regulations. A skilled bookkeeper can also provide valuable insights into a company’s financial health and help identify areas for improvement.

However, DIY bookkeeping may be suitable for small businesses with straightforward financial transactions and limited resources. It allows business owners to have more control over their finances and potentially save money on hiring external help. However, it is essential to recognize the potential risks and challenges of DIY bookkeeping, such as making errors that could lead to costly mistakes or non-compliance issues.

Determining whether outsourcing or DIY is more cost-effective depends on various factors specific to each business. For example, larger companies with complex financial transactions may benefit from hiring full-time bookkeepers who can dedicate significant time to managing their books effectively. On the other hand, smaller businesses might find it more practical and affordable to hire part-time or freelance bookkeepers who can provide support as needed.

A full charge bookkeeper plays an integral role in managing a company’s finances comprehensively. They go beyond basic bookkeeping tasks by taking on additional responsibilities such as preparing financial statements, analyzing data trends, and providing financial advice. Full charge bookkeepers possess a broader skill set and expertise that can benefit businesses seeking more comprehensive financial support.

For small business owners managing their own books, there are several simple tips to follow. First, it’s crucial to establish a system for organizing financial records and transactions. This could involve using accounting software or creating a spreadsheet to track income and expenses accurately. Implementing cost-saving strategies like automating repetitive tasks or outsourcing specific functions can help maximize productivity while maintaining accurate financial records.

To summarize, the business of bookkeeping is essential for maintaining accurate financial records and ensuring compliance with tax regulations. Businesses have the option to hire bookkeepers or manage their own books based on their specific needs and resources.

Outsourcing Bookkeeping Services

Pros and Cons of Outsourcing

Businesses often face the decision of whether to keep the task in-house or outsource it to a professional service. Each option has its own set of advantages and disadvantages that need careful consideration.

One major advantage of outsourcing bookkeeping is cost savings. By hiring an external service provider, businesses can save on expenses related to hiring and training in-house staff, providing office space and equipment, and offering employee benefits. Outsourced bookkeeping services often have specialized knowledge and expertise, which can lead to more accurate financial records.

However, there are potential drawbacks as well. One concern is the loss of control over sensitive financial information. When outsourcing bookkeeping tasks, businesses must trust the service provider with confidential data such as bank statements and payroll information. Ensuring the security and confidentiality of this information becomes crucial when choosing an outsourcing partner.

Another disadvantage is the potential loss of control over the bookkeeping process itself. In-house bookkeepers can adapt quickly to changing business needs or address any issues promptly. With outsourced services, there may be a time lag or dependency on external parties for resolving accounting matters.

To make an informed decision about outsourcing bookkeeping services, businesses should evaluate their specific circumstances. For example, small businesses with limited resources may find that outsourcing provides cost-effective solutions without compromising quality or accuracy. On the other hand, larger organizations with complex financial operations might prefer keeping bookkeeping functions in-house for better control and customization.

Cost Analysis for Outsourcing

Conducting a thorough cost analysis is essential when considering outsourcing bookkeeping services. This evaluation helps determine how outsourcing will impact a company’s finances compared to keeping the function in-house.

Firstly, it’s important to compare the expenses associated with in-house bookkeeping versus outsourcing costs. This includes salaries or wages paid to employees handling bookkeeping tasks internally versus fees charged by outsourced service providers. Additional considerations should include the costs of software, training, and ongoing support required for in-house bookkeeping.

Reference: Staff Accountant General Accounting Salary (Robert Half )

Secondly, businesses need to understand the long-term cost benefits of outsourcing. While initial savings may be evident through reduced overhead expenses, there may be other potential advantages. For example, outsourcing can free up valuable time and resources that can be redirected towards core business activities or strategic initiatives.

It’s worth noting that cost analysis is not limited to monetary factors alone. Businesses must also consider the intangible benefits and drawbacks associated with outsourcing bookkeeping services. This includes factors such as increased efficiency, improved accuracy, and potential risks related to data security.

Bookkeeping Service Fees – Client Perspective

Addressing common queries about bookkeeping rates and services

Potential clients often have several questions. Here, we address some of the most frequently asked questions to help you make an informed decision about pricing structures and the value you can expect from bookkeepers.

How much do bookkeepers charge for their services?

Bookkeeping rates can vary depending on various factors such as the complexity of your financial records, the volume of transactions, and the level of expertise required. On average, bookkeepers may charge an hourly rate ranging from $20 to $50. However, it is important to note that these rates can differ based on location and the specific needs of your business.

What services are typically included in bookkeeping?

Bookkeeping services encompass a range of tasks that help manage your financial records effectively. These include recording daily transactions, reconciling bank statements, managing accounts payable and receivable, preparing financial reports, and ensuring compliance with tax regulations. Bookkeepers also play a crucial role in maintaining accurate records for audits or financial reviews.

Can I customize my bookkeeping package?

Absolutely! Many professional bookkeepers offer customizable packages tailored to meet your specific business needs. Whether you require basic transaction recording or more comprehensive financial management services, you can work with a bookkeeper to create a package that aligns with your requirements and budget.

How do I determine if I need full-time or part-time bookkeeping support?

The amount of bookkeeping support needed depends on the size and complexity of your business operations. Small businesses with fewer transactions may benefit from part-time or even virtual bookkeeping assistance. On the other hand, larger businesses with high transaction volumes may require full-time in-house or dedicated outsourced support.

What value does hiring a professional bookkeeper bring to my business?

Hiring a professional bookkeeper brings numerous benefits to your business. Firstly, it allows you to focus on core activities and strategic decision-making instead of spending valuable time managing financial records. Bookkeepers also ensure accuracy and compliance, reducing the risk of errors or penalties. Their expertise can provide valuable insights into your business’s financial health, helping you make informed decisions for growth and profitability.

Can bookkeepers help with tax preparation?

Yes, many bookkeepers have a deep understanding of tax regulations and can assist with tax preparation. They can organize and classify your financial records, ensuring that all necessary documentation is in order for tax filing purposes. While bookkeepers can handle the initial steps of tax preparation, it’s important to consult with a certified accountant or tax professional for final review and submission.

Key Considerations for Bookkeepers

There are several key considerations that bookkeepers need to keep in mind. One of the first decisions they face is whether to hire full-time or part-time bookkeepers. This choice depends on factors such as the volume of work and the budget available for hiring.

Before determining how much to charge for their services, bookkeepers should assess the time required for regular bookkeeping tasks. This includes tasks like recording financial transactions, reconciling accounts, and preparing financial statements. By understanding the time commitment involved, bookkeepers can set fair and reasonable rates that reflect their expertise and effort.

Outsourcing bookkeeping services can be a cost-effective option for businesses with limited resources. By partnering with a reputable outsourced accounting firm, businesses can access professional bookkeeping services without the expense of hiring an in-house bookkeeper. Outsourced providers often have a team of experts who specialize in different areas of bookkeeping, ensuring accuracy and efficiency.

Utilizing accounting software like QuickBooks can streamline bookkeeping tasks and save time. With features such as automated data entry, bank reconciliation, and customizable reports, QuickBooks simplifies the process of managing financial records. Bookkeepers who leverage this software can enhance their productivity and deliver faster results to their clients.

Education and Its Impact on Pricing

Higher education plays a significant role in shaping bookkeeping rates. Bookkeepers with advanced degrees or specialized training may command higher fees due to their enhanced knowledge and expertise. Certifications such as Certified Public Bookkeeper (CPB) or Certified Bookkeeper (CB) also add value to a bookkeeper’s qualifications.

Communicating the expertise gained through continuous education is crucial when determining pricing strategies. Clients are more likely to recognize the value of a well-educated bookkeeper who stays updated with industry trends and regulations. Highlighting these qualifications can justify higher charges while instilling confidence in clients about the quality of service they will receive.

Selecting the Ideal Option for Businesses

When choosing a bookkeeping option for a business, several factors come into play. It is essential to align the services offered with the specific needs and goals of the business. Some businesses may require comprehensive bookkeeping services, including payroll management and tax preparation, while others may only need basic bookkeeping assistance.

Evaluating costs, expertise, and scalability are crucial for long-term success. While in-house bookkeepers offer convenience and immediate availability, they can be more expensive due to salary and benefits. On the other hand, outsourced bookkeeping services provide cost savings and access to a team of professionals but may have limitations in terms of customization or on-site support.

Optimizing Your Bookkeeping Business

Bookkeeping business can interesting as well as challenging at the same time. It can be painful at times but also rewarding if you focus on the right things. To optimize your bookkeeping business, efficient time management is key. By effectively allocating your time and resources, you can streamline your operations and increase productivity. One way to achieve this is by outsourcing certain bookkeeping tasks.

Outsourcing regular bookkeeping tasks can save you a significant amount of time, allowing you to focus on more important aspects of your business. By delegating these responsibilities to professionals who specialize in bookkeeping services, you can ensure accuracy and efficiency in your financial records.

Another valuable tool for optimizing your bookkeeping processes is accounting software like QuickBooks. This software provides a streamlined platform for managing various financial tasks such as invoicing, expense tracking, and generating reports. By utilizing QuickBooks or similar accounting software, you can automate many manual processes, saving both time and effort.

Finding the right balance between full-time and part-time bookkeepers is crucial for cost-effectiveness. Hiring full-time bookkeepers may be necessary if your business has high transaction volumes or complex financial needs that require constant attention. On the other hand, part-time bookkeepers can be a more affordable option for businesses with lower transaction volumes or simpler financial requirements.

Pricing Strategies for Revenue

Implementing effective pricing strategies is essential for maximizing revenue in your bookkeeping business. Different pricing strategies can be employed based on your revenue goals and the value you provide to clients.

One approach is value-based pricing, where the price of your services is determined by the perceived value they bring to clients. Instead of solely considering factors like time spent on tasks or overhead costs, value-based pricing focuses on the outcomes and benefits clients receive from using your professional bookkeeping services.

Balancing profitability with competitive pricing in the market is also crucial when determining how much to charge for bookkeeping services. While it’s important to remain competitive within the industry, it’s equally vital to ensure that your pricing reflects the value and expertise you bring to the table.

Talking Points to Attract Clients

Crafting compelling messaging is essential to attract potential clients to your bookkeeping business. Clearly communicate your unique selling points and competitive advantages, highlighting what sets you apart from other bookkeeping service providers.

When promoting your services, focus on the value proposition of professional bookkeeping. Emphasize how hiring a professional bookkeeper can save time, reduce errors, and provide accurate financial information for informed decision-making. Highlighting these benefits will help potential clients understand why investing in professional bookkeeping services is worth it.

Software and Tools for Bookkeeping

Efficient bookkeeping relies heavily on the use of accounting software and tools. One popular choice for basic bookkeeping tasks is QuickBooks, which offers a user-friendly interface and a range of features to help manage financial records. Many outsourced bookkeeping services also utilize software like QuickBooks Online, allowing them to efficiently handle clients’ financial data.

Time bookkeepers heavily rely on software to effectively manage and track financial records. By using specialized time bookkeeping software, they can accurately record billable hours, track expenses, and generate reports for clients. This not only streamlines the bookkeeping process but also ensures accuracy in financial reporting.

In addition to general accounting software like QuickBooks, there are specific tools available that assist with different aspects of bookkeeping. One such tool is FreshBooks, which offers numerous benefits for bookkeepers. It helps streamline processes by automating repetitive tasks such as invoicing and expense tracking. By reducing manual data entry, FreshBooks minimizes the risk of errors in financial records.

Moreover, tools like FreshBooks enhance client collaboration and communication. They provide a platform where clients can easily access their financial information, view reports, and communicate with their bookkeeper. This level of transparency fosters trust between the client and the bookkeeper while ensuring that both parties have real-time access to relevant information.

When choosing accounting software for bookkeeping services, several factors need consideration. Evaluating features such as reporting capabilities, scalability options (to accommodate growing businesses), compatibility with client needs (such as integration with other systems), and ease of use are all crucial considerations.

The choice of accounting software has a significant impact on the efficiency and accuracy of bookkeeping tasks. Selecting user-friendly software that aligns with specific business requirements can streamline operations significantly while minimizing errors in financial records.

Furthermore, outsourcing bookkeeping services can offer numerous benefits for businesses looking to focus on core activities rather than handling regular bookkeeping tasks. By utilizing software like QuickBooks Online, outsourced bookkeepers can efficiently manage clients’ financial records remotely. This allows businesses to save time and resources by delegating their bookkeeping needs to professionals who specialize in the field.

Choosing right Bookkeeping Proposal Software

Streamline Client Onboarding

Selecting the right bookkeeping proposal software is integral for accounting professionals looking to streamline their services and enhance their operational efficiency. The ideal software should not only simplify the proposal creation process but also offer robust features that cater to the dynamic needs of bookkeeping practices. One of the critical considerations is interactive bookkeeping fees; the software should allow for easy customization and updating of fee structures depending on the services offered. This flexibility enables accountants to quickly adjust their proposals to reflect different client needs and service tiers.

Reusable Fee Library, Services Information Library

Additionally, a content library can significantly reduce the time spent creating proposals by providing reusable service information, such as ledger entries. Having access to a well-organized repository of service descriptions, engagement letters, and other key documents ensures consistency across proposals and saves time that would otherwise be spent on drafting from scratch for each new client.

A monthly schedule of bookkeeping services within the proposal software helps in clearly laying out the frequency of services provided, fostering better understanding and agreement between bookkeepers and clients. This schedule can include recurring tasks, deadlines, and checkpoints that keep both parties aligned on the deliverables.

Automate Proposal Process

Most importantly, automation has become a cornerstone of modern bookkeeping practices. The right proposal software should automate various aspects of the onboarding process, from generating proposals based on predefined templates to sending reminders for information collection. Moreover, it should integrate with payment systems to automate the billing and collection process, reducing the administrative burden on bookkeepers and ensuring timely compensation for their services.

In summary, the right bookkeeping proposal software should act as a comprehensive solution that supports interactive fee tailoring, utilizes a content library for efficiency, manages data cleanup processes, schedules services effectively, and embraces automation to enhance client onboarding and payment collection. This software becomes a powerful tool in a bookkeeper’s arsenal, allowing them to focus more on delivering quality services and less on administrative tasks.

Bookkeeping engagement letter software

When selecting software to streamline your bookkeeping engagement letter process, it’s imperative to consider a solution that not only aligns with AICPA guidelines for obtaining signed bookkeeping engagement letter but also offers features that enhance the efficiency of your practice. A robust software should facilitate interactive bookkeeping fees presentations, allowing clients to understand and agree to your pricing models seamlessly. To further optimize operations, look for a system that includes a content library, where frequently used service information and ledger entries can be stored and reused, minimizing repetitive data entry.

The terms of bookkeeping services should be clearly defined within the software, ensuring clients have a transparent understanding of what they are agreeing to. Automation plays a critical role in modern bookkeeping practices; hence, the ideal software should automate the entire client lifecycle from onboarding to collecting payments, reducing manual intervention and allowing for a more streamlined approach. This automation extends to compliance, where the software should assist in ensuring that all engagement letters are signed in accordance with AICPA standards, thus maintaining professional and legal integrity.

Conclusion

Congratulations! You’ve reached the end of our comprehensive guide on bookkeeping charges and setting your rates. We’ve covered everything from deciphering bookkeeping charges to optimizing your bookkeeping business. Now that you have a solid understanding of the factors that influence pricing and how to maximize your profitability, it’s time to put this knowledge into action.

Take a moment to reflect on what you’ve learned and consider how you can implement these strategies in your own bookkeeping practice. Whether you’re just starting out or looking to revamp your existing rates, remember that finding the right balance is crucial. By valuing your expertise, considering market trends, and leveraging technology, you can position yourself for success in the competitive world of bookkeeping.

Now, go forth and confidently set your bookkeeping rates, knowing that you have the knowledge and tools to thrive in this industry. Best of luck on your journey!

Frequently Asked Questions

How do I determine how much to charge for bookkeeping services?

Determining your bookkeeping rates depends on various factors such as your experience, location, and the complexity of the client’s financials. Research industry standards, consider your expertise, and factor in overhead costs to set a competitive yet profitable rate.

Should I charge an hourly rate or a fixed fee for bookkeeping?

Both options have their pros and cons. Charging an hourly rate allows for flexibility but may result in varying costs for clients. A fixed fee provides predictability but requires careful estimation of time spent on each project. Consider your business model and client preferences when deciding which approach suits you best.

What additional services can I offer along with bookkeeping?

Consider offering value-added services like financial analysis, budgeting assistance, or tax planning. These complementary offerings can enhance the overall value you provide to clients while increasing your revenue streams.

How can I optimize my bookkeeping business for maximum efficiency?

Leverage technology by using accounting software that automates repetitive tasks and streamlines processes. Implement standardized workflows, establish clear communication channels with clients, and regularly assess and improve your systems to boost productivity.

Is it advisable to outsource bookkeeping services?

Outsourcing bookkeeping services can be beneficial if you lack the expertise or time to handle all aspects of the job yourself. It allows you to focus on core business activities while ensuring accurate financial records through professional assistance.

0 Comments