A wide range of organizations find themselves subject to audit requirements, not just as a matter of compliance but also as a strategic move to enhance their credibility in the market. Publicly traded companies are obligated under law to undergo annual audits to protect the interests of shareholders and the public. Similarly, private entities, especially those seeking to raise funds or expand their operations, opt for audits to demonstrate their financial integrity to potential investors or lenders. Non-profit organizations, too, face audit mandates to ensure transparency and proper use of funds, especially when they receive grants or public donations. Even governmental bodies are not exempt from these requirements, with audits serving as a tool for accountability and efficient resource management. These diverse needs underscore the universal importance of audit engagements across sectors, setting the stage for a deeper dive into the critical role of the audit engagement letter.

For such organizations, engaging an auditor is a critical step towards ensuring financial transparency, compliance with regulatory standards, and building trust with stakeholders. This engagement not only helps in identifying any discrepancies or areas of improvement in financial reporting but also plays a vital role in enhancing the credibility of the organization’s financial health. At the heart of this engagement lies the audit engagement letter, a formal document that outlines the scope, expectations, and responsibilities of both the auditor and the client. Understanding the key elements of this agreement is crucial for both parties to ensure a thorough, efficient, and transparent audit process. In this blog post, we will navigate through these essential components, highlighting their significance and how they lay the groundwork for a successful auditing relationship.

When diving into the world of audit engagements, understanding the crucial role of an audit engagement letter is paramount. This document serves as a formal agreement outlining the terms and scope of an audit between a client and an auditor. By clearly defining responsibilities, expectations, timelines, and fees upfront, both parties can ensure a smooth and transparent auditing process. The audit engagement letter not only establishes trust but also helps mitigate misunderstandings or disputes that may arise during the audit. Stay tuned to discover why this foundational document is essential for successful audit engagements.

Defining Audit Engagement

Audit engagements refer to contractual agreements between auditors and clients for auditing financial statements. Audit engagement letters specify the scope, objectives, and responsibilities in this business arrangement. They establish clear expectations and boundaries.

Purpose

An audit engagement letter’s purpose is to define the terms of the audit process clearly. It sets the tone for conducting a thorough review of financial statements. Outlining expectations in the letter is crucial.

Scope

The audit engagement letter covers specific areas such as the objectives, responsibilities, and limitations of the audit. Defining these scopes helps set boundaries for the audit process, ensuring clarity in operations. A well-defined scope enhances efficiency.

Importance

Audit engagement letters play a vital role in formalizing audits, protecting both auditors and clients. They enhance transparency by outlining roles and responsibilities clearly. This formal agreement fosters accountability throughout the auditing process.

Importance of Having an Audit Engagement Letter

Why does one need accounting engagement letter?

An audit engagement letter is a crucial document that outlines the terms and conditions of an audit engagement between an auditor and a client. This formal agreement serves as a roadmap for the entire audit process.

Contractual Agreement

The audit engagement letter acts as a contractual agreement between the auditor and the client, establishing a legal relationship. It details the responsibilities, objectives, and limitations of the audit engagement, ensuring clarity on both sides.

Clarity on Engagement Terms

One key aspect of an audit engagement letter is defining the scope and objectives clearly. By outlining these aspects in detail, both parties can avoid misunderstandings throughout the audit process. The letter sets expectations from the beginning.

Mitigating Risks and Establishing Expectations

The audit engagement letter plays a vital role in identifying and mitigating potential risks associated with the audit process. By setting clear expectations for both the auditor and the client, it helps prevent disputes that could arise from misunderstandings or unmet expectations. This proactive approach ensures that both parties are aware of their roles, responsibilities, and the standards to which the audit will be conducted, thereby reducing the likelihood of conflicts and promoting a smoother audit process.

Legal and Professional Compliance

An audit engagement letter, which can be automated using engagement letter software helps ensure that both the auditor and the client adhere to legal and professional standards. By explicitly stating the applicable laws, regulations, and auditing standards, the letter acts as a reminder to comply with these requirements throughout the audit process. This adherence to professional guidelines not only enhances the credibility of the audit but also protects both parties from potential legal consequences stemming from non-compliance.

Framework for Communication

This document establishes a framework for communication between the auditor and the client. It typically includes provisions for regular updates, reporting formats, and timelines, as well as contact information for key personnel involved in the audit. Such structured communication is essential for the timely resolution of issues, making informed decisions, and ensuring that the audit progresses efficiently. Furthermore, it fosters a cooperative relationship between the auditor and the client, which is conducive to a thorough and effective audit.

Clearly Identifying Essential Components of Audit Engagement Letter

It is crucial to define the requirements and objectives clearly. This document outlines the systems, controls, and responsibilities of all parties involved in the audit process. The terms within this document set the foundation for a successful audit engagement.

The scope of an audit engagement refers to the specific tasks and activities that will be performed during the audit. It is essential to clearly define these parameters to ensure both parties understand their roles and expectations. Limitations must be outlined to manage expectations regarding what will not be covered in the audit process.

Establishing a strong relationship between all parties involved is vital for mitigating risks throughout the audit process. By fostering open communication and trust, potential issues can be addressed proactively, leading to a more efficient and effective audit.

Auditor Responsibilities

Auditors have key responsibilities they must fulfill during an audit engagement. These include conducting thorough assessments of financial records, verifying compliance with regulations, and identifying any discrepancies or irregularities.

Fulfilling these responsibilities ensures that audits are conducted accurately and provide reliable information for decision-making purposes. Auditors play a critical role in upholding transparency and integrity within organizations through their diligent work.

Management Responsibilities

Management also carries significant responsibilities during an audit engagement. They are required to provide auditors with access to relevant documents, facilitate interviews with staff members, and address any queries promptly.

Cooperation from management greatly impacts the efficiency of the audit process. By being transparent, responsive, and proactive in addressing auditor requests, management contributes to a smoother auditing experience.

Financial Reporting

The audit engagement letter directly influences financial reporting by setting out the terms under which audits will be conducted. It ensures that audits are carried out according to established standards while maintaining objectivity and independence.

This document plays a crucial role in ensuring accuracy in financial reports by outlining procedures for data collection, analysis methods, and reporting requirements. Compliance with reporting standards is upheld through adherence to the guidelines stipulated in the letter.

By emphasizing clarity on requirements, defining responsibilities clearly among all parties involved, and establishing robust relationships between auditors and management, the effectiveness of an audit engagement can be maximized.

Crafting the Letter

Crafting the audit engagement letter is a critical step in initiating the audit process. This document serves as a formal agreement between the auditing firm and the client, outlining the terms and conditions of the engagement. It establishes a clear understanding of each party’s responsibilities, ensuring a smooth and efficient audit.

When drafting the letter, it is essential to specify the scope of work to be performed during the audit. This includes detailing the objectives, timelines, and deliverables expected from both parties. By clearly defining these parameters upfront, any potential misunderstandings or disputes can be avoided later on.

The contractual arrangement outlined in the engagement letter sets the foundation for a successful audit relationship. Clarity and transparency are key in this document to mitigate any risks associated with the engagement. Both parties must agree on all terms to ensure a harmonious working relationship throughout the process.

Understanding the risks involved in an audit engagement is crucial for all parties involved. The letter should clearly outline each party’s obligations and liabilities to manage these risks effectively. By acknowledging and addressing potential challenges upfront, both parties can navigate through the requirements smoothly.

Key Elements

- Objective of audit services engagment

- Scope of audit service: detailed description of services

- Responsibilities of both parties: auditor and management

- Audit methodology

- Timelines and deadline for audit activities and reports

- Engagement fee structure

- Reporting requirements

Identifying these key elements ensures that all aspects of the audit engagement are covered comprehensively. Each component plays a vital role in facilitating effective communication between the auditing firm and its clients.

The responsibilities of each party are crucial elements detailed in the audit engagement letter. From reviewing financial statements to assessing controls and systems, these responsibilities help establish a framework for a successful audit process. Clear delineation ensures accountability.

In addition to outlining responsibilities, it is essential to identify and document potential risks associated with the audit engagement. Understanding these risks allows for proactive measures to be put in place to address issues that may arise during the course of the audit.

Moreover, setting forth specific terms and requirements within the audit engagement letter is paramount. Defining timelines, deliverables, and communication channels ensures that expectations are managed effectively throughout the entire process.

Audit Service Objectives

This section outlines the main goals of the audit and defines the boundaries of the work to be performed. To ensure clarity and alignment, audit objectives are explicitly defined in the audit engagement letter. This document outlines the purpose and scope of the audit, providing a roadmap for both parties involved. By clearly stating these objectives, any ambiguity is eliminated.

Why It is important

It sets clear expectations for both the auditor and the client, ensuring that both parties agree on what will be covered during the audit.

Points to remember

- Be specific about what financial statements or documents will be audited.

- Clarify any services that are not included in the scope.

- Mention if there are any limitations to the scope of the audit.

Examples, notes

The objective of this audit is to express an opinion on whether your financial statements are presented fairly, in all material respects, in accordance with applicable financial reporting framework.

Scope of Audit

Defining the scope of an audit within the engagement letter is critical. This section clarifies what areas will be covered during the audit process, ensuring both parties have a clear understanding of what will be reviewed.

Aligning this scope with the client’s needs is imperative as it ensures that all relevant aspects are addressed adequately. A well-defined scope guarantees that nothing important is overlooked during the auditing procedure.

A comprehensive scope not only covers all necessary aspects but also helps in focusing efforts on areas that are most critical or prone to errors or discrepancies.

Terms and Conditions

Clearly outlining terms and conditions within the engagement letter is paramount for setting expectations right from start. These details prevent misunderstandings by providing clarity on payment schedules, confidentiality agreements, dispute resolutions, etc.

Fee Schedule

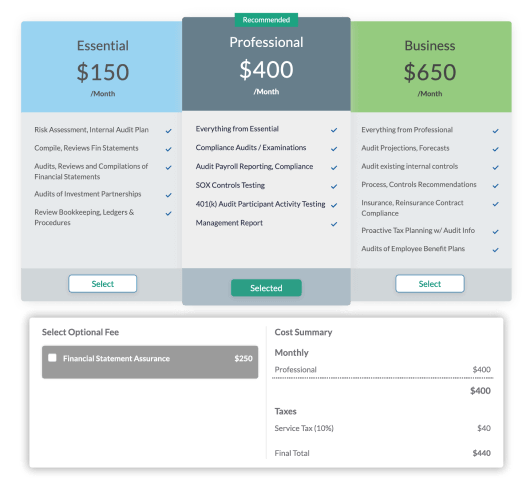

The fee schedule included in an audit engagement letter typically consists of hourly rates or fixed fees based on project complexity. Determining fee structures involves considering factors such as resources utilized, expertise required, and time invested. Transparency in fee arrangements fosters trust between both parties involved in audit engagements.

Report Types

Various types of reports can be included in an engagement letter, each serving different purposes based on specific circumstances. These reports range from general findings to detailed analyses tailored to meet varying needs.

Choosing an appropriate report type depends on factors such as audience requirements, regulatory standards, and internal policies. Selecting the right report type enhances transparency and facilitates better decision-making processes.

Selecting an accurate report type ensures that information presented aligns with stakeholders’ expectations while meeting statutory compliance obligations effectively.

Responsible Party for Preparing an Audit Engagement Letter

This part clarifies what is expected from the auditor and the management team during the audit process

Why It is important

It helps in preventing misunderstandings by detailing the duties and obligations of each party involved.

Points to remember

- For the auditor: mention standards or regulations guiding the audit.

- For management: emphasize their responsibility for the preparation and fair presentation of financial statements.

Examples, notes

Management is responsible for maintaining effective internal control over financial reporting and for making all financial records available to us during the audit.

Preparation Process

The audit engagement letter is typically prepared by the auditor conducting the audit. It serves as a crucial document outlining the terms and responsibilities involved in the audit process.

Importance of Clear Responsibilities

Clearly outlining responsibilities in the engagement letter is essential to avoid misunderstandings between the auditor and the client. This clarity helps establish expectations and ensures both parties are on the same page.

Aligning with Contractual Agreement

It is vital to align engagement terms in the audit engagement letter with the contractual agreement between the auditor and the client. This alignment strengthens the legal framework of their relationship.

Review Before Signing

Parties involved must thoroughly review and understand all aspects of the audit engagement letter before signing it. This review process helps identify any discrepancies or areas needing clarification.

Audit Methodology

This part describes the approach and techniques that will be used during the audit process.

Why It is important?

It gives the client an understanding of how the audit will be conducted and sets the groundwork for audit procedures.

Points to remember

- Include a general overview of the audit methodology.

- Explain that the approach may vary depending on findings during the audit.

Examples, notes

Our audit will be conducted in accordance with auditing standards and will include tests of your bookkeeping, accounting records and other procedures we consider necessary.

You can include audit process, methodology such as these

- Risk Assessment: Identifying and assessing areas of significant financial statement risks. This helps in focusing our efforts on the areas that matter the most.

- Audit Plan Development: Based on the risk assessment, we develop a tailored audit plan. This plan outlines the audit procedures to be performed in response to the identified risks.

- Execution of Audit Procedures: Implementation of the audit plan through various procedures such as inspection, observation, inquiry, and confirmation. This includes testing of the effectiveness of internal controls and substantive testing of financial statement balances.

- Audit Evidence Collection and Evaluation: Gathering sufficient and appropriate audit evidence to support our opinion. This involves evaluating the evidence collected to conclude on the fairness and reliability of the financial statements.

There are multiple auditing standards followed all over the world such as ISAs, GAAS, PCAOB, FRC, etc. As appropriate, you should include the auditing standard you are following.

Timelines for Audit Service Activities

When initiating an audit engagement, it is crucial to establish clear timelines in the engagement letter. This document marks the official start date of the audit process, ensuring both parties are aware of their responsibilities. The letter should specify a definite start date for the audit activities.

Defining the scope of the audit engagement is essential in setting objectives and outlining responsibilities. It delineates what will be examined during the audit and clarifies each party’s role in achieving these objectives. By clearly defining these aspects, any potential misunderstandings can be avoided.

The engagement terms within the letter serve as a contractual agreement between the auditing firm and the client. These terms detail the arrangement between both parties, including specific tasks, deliverables, and expectations throughout the audit process. It acts as a binding document that governs their professional relationship.

To ensure smooth progress, establishing a timeline for completing the audit engagement is vital. All parties involved need to agree on realistic deadlines for different stages of the audit process. This alignment helps in managing expectations and ensures timely completion of all necessary procedures.

This aspect of Audit Engagement Letter specifies when the audit will start, major milestones, and when it is expected to be completed.

Why It is important?

Helps in planning and ensures that both parties are aware of and agree on critical dates.

Points to remember

- Provide realistic timelines that consider both parties’ schedules.

- Mention any key deadlines, such as regulatory or reporting deadlines.

Examples, notes

The audit is scheduled to commence on [date] with a planned completion date of [date]. This timeline is contingent upon timely access to necessary documents.

Fee Structure

This part provide details about how audit service pricing will be calculated, payment terms, and any additional costs that may arise.

Why It is important?

It ensures transparency about the audit cost, helping prevent disputes over fees later on.

Points to remember

- Be clear about what is included in the quoted fee and what might incur additional charges.

- Specify payment terms and conditions.

Examples, notes

Our fees are based on the time required by individuals assigned to the engagement plus out-of-pocket expenses. Invoices are payable within 30 days of receipt.

Sending the Audit Engagement Letter

Sending out an audit engagement letter involves following a systematic process to guarantee its proper delivery. The auditing firm typically dispatches this document to initiate formal communication with their client regarding upcoming audits.

The timing of sending out this letter is critical as it sets off the entire audit process timeline. Using secure methods like registered mail or electronic signatures ensures that both parties receive and acknowledge receipt promptly.

Confirming receipt of this engagement letter holds significant importance as it validates that both parties are on board with its contents and terms outlined within it. This confirmation serves as evidence that all involved parties have acknowledged their roles and responsibilities moving forward.

Signing Process

The signing process of an engagement letter involves several steps to formalize this contractual agreement between an auditing firm and its client effectively. Both parties must designate authorized signatories who hold decision-making power within their organizations.

Signing this document signifies acceptance of its terms by both parties, indicating their commitment to fulfilling respective obligations outlined within it. It carries legal implications as it binds them to adhere to agreed-upon procedures throughout the course of conducting audits. Use of eSignature software is pretty much common these days.

Preparing for Audit

To ensure a successful audit engagement, it is crucial to review the objectives specified in the audit engagement letter. Understanding these objectives helps define the scope of the audit and identifies which financial statements will be scrutinized. By clarifying these details, all parties involved can align their efforts effectively.

Each party’s responsibilities are outlined in the engagement letter, establishing clear expectations for everyone involved in the process. This clarity ensures that each party understands their role and contribution to the audit engagement, promoting a smooth and efficient business arrangement.

Getting started on an audit requires gathering essential documentation such as financial records, reports, and other relevant documents. These materials are necessary for auditors to conduct a thorough examination of the financial information provided by the client. Ensuring all required documents are prepared in advance streamlines the audit process.

Assessing potential risks associated with an audit engagement is critical to preemptively addressing any challenges that may arise during the process. By identifying these risks early on, strategies can be developed to mitigate them effectively, safeguarding the integrity of the audit and its outcomes.

Information Collection

Collecting relevant information for an audit is vital as it forms the foundation of a comprehensive examination. The quality and accuracy of this information directly impact the overall effectiveness of an audit.

Efficient information gathering enhances audit quality by providing auditors with reliable data to analyze during their assessment. Thoroughly collected information minimizes errors and discrepancies, leading to more accurate findings and conclusions.

- Ensuring all necessary documents are readily available

- Conducting detailed interviews with key personnel

- Utilizing technological tools for data extraction

Ensuring Preparedness

Both auditors and clients play pivotal roles in ensuring preparedness for an upcoming audit. Being well-prepared not only facilitates a smoother auditing process but also contributes to achieving more accurate results within shorter timeframes.

Well-prepared audits offer numerous benefits such as reduced disruptions to daily operations, quicker completion timelines, and increased confidence in financial reporting accuracy. Effective communication between auditors and clients fosters transparency throughout every stage of preparation, ensuring alignment on expectations and requirements.

Legal and Ethical Considerations

In audit engagements, responsibilities are crucial for both parties to ensure ethical conduct and legal compliance. The auditor must maintain independence and objectivity throughout the process. The client, on the other hand, should provide accurate information and access to necessary documents.

The objectives of engagement terms involve setting clear expectations for the audit scope. Defining the extent of review procedures helps in determining the depth of analysis required for financial statements. Clarity in objectives minimizes misunderstandings between the auditor and client.

Key requirements in an engagement letter establish a solid contractual agreement. These include detailing the scope of work, timelines for completion, fee structure, and responsibilities of each party. A well-defined engagement letter reduces disputes by ensuring mutual understanding.

Limitations in an audit engagement involve inherent risks associated with reliance on internal controls and financial statement preparation. Auditors may face constraints due to time limitations or lack of cooperation from the client. Understanding these limitations is vital for effective risk management.

Standard No. 16

Standard No. 16 plays a critical role in guiding audit engagements by outlining specific requirements for auditors to follow. Compliance with this standard ensures consistency and quality across different audits, promoting reliability in financial reporting processes.

Compliance with Standard No. 16 enhances audit quality by establishing uniform practices that improve accuracy and transparency during audits. Adhering to these standards reduces errors and inconsistencies, leading to more reliable financial statements for stakeholders.

Key requirements of Standard No. 16 include documenting audit evidence thoroughly, maintaining independence and objectivity throughout the engagement, and obtaining sufficient understanding of internal controls relevant to the audit objectives.

Signature Importance

Signatures on an engagement letter signify agreement between the auditor and client regarding the terms outlined in the document. They serve as tangible evidence of mutual consent to proceed with the audit engagement based on specified conditions.

The act of signing an engagement letter demonstrates commitment from both parties towards fulfilling their respective obligations as per the agreed-upon terms. Signatures indicate a formal acceptance of responsibilities outlined in the document before commencing any auditing activities.

The presence of signatures on an engagement letter holds significant legal implications, indicating that both parties have accepted their roles under a binding contract governed by applicable laws regulating audit engagements.

Streamlining the Process

To streamline the audit engagement process, it is crucial to define clear objectives right from the start. This ensures that all parties involved understand the purpose and scope of the audit.

Implementing robust systems and controls throughout the engagement helps in meeting all specified audit requirements effectively. By having these mechanisms in place, potential issues can be identified and addressed promptly.

Establishing a structured business arrangement with well-defined responsibilities and limitations for both parties is essential. This clarity helps in avoiding misunderstandings during the audit process.

Regularly reviewing and documenting the progress of the audit is vital for addressing any potential risks that may arise. It also ensures that all terms of the engagement are being followed diligently by all involved parties.

Client Information

When drafting an audit engagement letter, detailing accurate client information is crucial for a smooth process. This includes specifics such as company name, address, contact persons, and other relevant details.

Accurate client information not only facilitates a seamless audit but also helps in maintaining transparency between both parties. It enables auditors to conduct their work efficiently without unnecessary delays or complications.

Confidentiality plays a significant role concerning client information. Highlighting how this data will be handled securely within the engagement letter builds trust with clients and emphasizes respect for their privacy.

Tips and Tricks

Practical tips for drafting an effective audit engagement letter include being concise yet comprehensive in outlining key aspects of the arrangement. Clearly defining roles, responsibilities, timelines, and expectations enhances clarity for all parties involved.

Common pitfalls to avoid when writing an engagement letter include using vague language or ambiguous terms that could lead to misinterpretation. Ensuring precise wording avoids confusion down the line during audits.

Enhancing communication within the letter involves using simple language that conveys complex ideas clearly. Providing examples or scenarios can help illustrate points better and improve understanding among stakeholders.

Closing Thoughts

You now grasp the importance of an audit engagement letter, ensuring clarity, expectations, and legal protection. Crafting a comprehensive letter with all essential components sets the tone for a successful audit process. Remember, timely preparation and understanding legal and ethical considerations are crucial steps in this process. Streamlining the procedure will not only save time but also enhance the efficiency of your audit engagements.

Take action today by implementing these insights into your audit practices. Strengthen your client relationships, safeguard your interests, and streamline your operations by prioritizing the creation of detailed and well-crafted audit engagement letters. Your commitment to excellence in this aspect will undoubtedly set you apart in the world of auditing.

Frequently Asked Questions

What is the purpose of an audit engagement letter?

An audit engagement letter outlines the responsibilities of both parties, sets expectations, defines scope, and helps avoid misunderstandings during the audit process. It establishes a formal agreement between the auditor and client.

Who is typically responsible for preparing an audit engagement letter?

The auditor or auditing firm is usually responsible for drafting and sending out the audit engagement letter to the client. This ensures that all necessary components are included and align with professional standards.

Why are timelines important when sending and signing an engagement letter?

Setting clear timelines for sending and signing the engagement letter helps in initiating the audit process promptly. It ensures both parties commit to deadlines, allowing sufficient time for preparations and conducting a thorough audit.

What are some essential components that should be clearly identified in an audit engagement letter?

Key components include objectives of the audit, scope of work, responsibilities of both parties, timeline for completion, fee structure, confidentiality agreements, any limitations on liability, and terms of termination. Clearly defining these aspects minimizes potential disputes.

How can I streamline the process of crafting an effective audit engagement letter?

To streamline this process effectively:

- Use audit engagement letter templates or standardized formats.

- Customize each letter to suit specific engagements.

- Clearly communicate requirements with clients upfront.

- Ensure legal compliance throughout drafting.

- Review and refine templates periodically for improved efficiency.

0 Comments