Unveiling the Power of Three-Tiered Pricing: Why CPA Accounting Firms Must Adopt This Pricing Strategy

Accounting services pricing

Before we jump to pricing aspects of accounting services, we need to understand that usually accounting, bookkeeping work is outsourced for certain reasons. Because it has been outsourced for quite some time and the delivery of these accounting firm represented financial health of businesses, there have been regulations and expectations of compliance for these services.There have been specialization within the broad categories of accounting services e.g. tax preparation requires the professional to be skilled about tax laws hence should be certified by specific institute like Enrolled Agents (EA) are certified by IRS or auditors or CPAs.

To set things in perspective, do you know what are the broad categories of accounting services we are referring to?

Accounting services t can be about Bookkeeping, Financial Control, Tax Preparation, Financial Audit, Payroll, Forensic Audit, Virtual CFO or mix of these services.

Let’s look at it from their client’s perspective

Accounting is a specially skill that regular business owner do not always have or may not want to keep doing accounting on a regular basis. Business owners are stressed to sustain, grow their business say restaurant, eCommerce, healthcare, HVAC, etc but struggle with business accounting can put them in a spot. Additionally, mere accounting does not help a business grow.

- For a regular business owner, bookkeeping, accounting sucks a good amount of time

- Plus accounting, tax laws keep changing rapidly

- You need to learn new technology stacks or keep up with its changes

- DIY accounting can be satisfying for some but it has a huge learning curve all the time

From Accounting firm’s perspective

To be a professional public accountant (CPA), you have to pass the CPA exam; to be approved tax agent, you have to get enrolled agent certification. To carry out CPA’s responsibilities one has to abide by the professional guidelines laid out by AICPA (in US), ACCA (in UK), IPA (in Australia), CPA Canada (in Ca), etc.

If you are a CPA/ owner of accounting firm, accounting is your job, it earns bread-butter for you. Helping others with their accounting is how you do your business. Things that come along with it is part of your job such as

- Changing accounting standards or tax laws

- Learning new tools, using technology, process to streamline accounting practice

- Educating clients about options available and recommending right ones

Pricing challenges for CPAs, accounting firms

CPAs and accountants often face challenges when pricing their accounting services. To ensure profitability and maintain a competitive edge, it is crucial to avoid common pricing mistakes.

Critical pricing challenges

The gap between the value of service versus cost of service should be higher, or else you are running a loss making business.

Value of service is perceived by your client and cost of service is from point of view (PoV) of CPAs/ accounting service provider as mentioned in the above section.

Additional pricing challenges

Quite a few times, accounting firm owner are indifferent to competitive market pricing or neglect market research about it.

- Lack of competitive market understanding means, they may not be differentiating services

- Failing to communicate value effectively

- Inconsistent pricing

- Not considering client needs

- Neglecting profitability analysis

- Over-reliance on billable hours, and

- Lacking a pricing strategy

How can CPA/ CA firm price its accounting services?

The mindset of pricing service as a billable hours has to change. Imagine the extreme scenario, there is AI advancement, RPA for accounting jobs is not a futuristic idea, it is becoming a reality.

To come up with effective pricing, accountants need to reorient, recognize the value they bring, considering all costs, conducting market research, differentiating their services, effectively communicating value, maintaining consistent pricing, catering to client needs, analyzing profitability, exploring alternative pricing methods, and developing a pricing strategy, CPAs and accountants can establish fair and profitable pricing structures. This allows them to attract and retain clients, achieve growth, and stay competitive in the accounting industry.

One of the way to implement modern pricing strategy is using three options pricing or accounting services tiered pricing.

What is tiered pricing?

Three-tiered pricing involves offering different service levels at varying price points, providing customers with options that align with their needs and budget. These service levels or bundles are commonly called as tiers

- The tiers are categorized as basic, standard, and premium, each offering distinct features and benefits catering to different customer segments.

- For businesses, this model enhances revenue potential, provides upselling opportunities, simplifies decision-making, and communicates value effectively.

- Customers benefit from choices, the ability to select the level of service that suits their needs, transparency, and clear understanding of costs and benefits.

Why accounting firms should implement 3 tiered pricing?

Implementing a three-tiered pricing structure can offer so many advantages for CPA and accounting firms when engaging with prospective clients.

Here are 8 reasons why incorporating a three-tiered pricing strategy can benefit these firms:

1. Increased Flexibility

A three-tiered pricing approach provides flexibility in offering service options to prospective clients. By presenting multiple pricing tiers, firms can cater to clients with varying needs, budgets, and expectations. e.g.

- Prospective clients looking for bookkeeping service can opt for standard tier option

- Those looking bookkeeping + financial accounting can opt for second tier

- For advanced financial controller service, prospective clients can opt for highest tier.

This flexibility allows firms to capture a broader range of clients and tailor their services to meet specific requirements.

2. Value Based Differentiation

Each pricing tier or pricing option can be designed to highlight different levels of service and value. If you are able to clearly articulate the features and benefits associated with each tier, you can demonstrate the value each option provide at different price points.

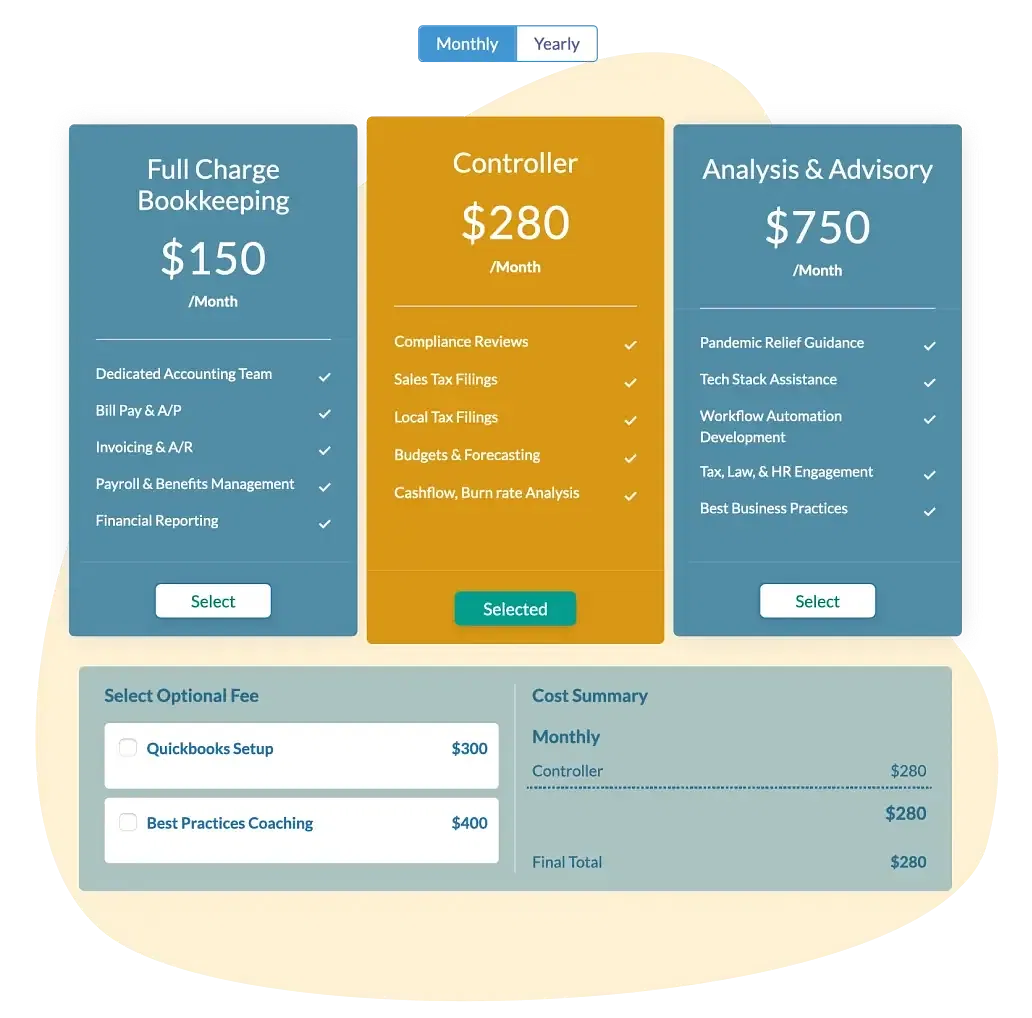

- Say priced at $150/ month, lowest pricing option you manage clients’ books, accounts receivable (AR), accounts payable (AP), Payroll and basic financial reporting

- In the next level of value pricing $300/month, you will review clients financials for compliance, tax return preparation, budget and forecasting, cashflow analysis, etc.

- The highest pricing option say at $750/month, you will automate financial workflow for the client, turn the engagement into more like a monthly advisory service like its own CFO

Such options enable prospective clients to choose the tier that best aligns with their needs and budget, fostering transparency and ensuring clients understand the value they receive.

3. Upselling Opportunities

A three-tiered pricing structure provides an opportunity for upselling or cross-selling services. Take above example. Prospective clients who might have opted for a lower-priced tier otherwise, would have realized that CPA/accounting firm provides him additional services that s/he needs and s/he can decide to upgrade to a higher-priced tier. This can lead to increased revenue and enhanced client relationships as firms have the opportunity to offer more comprehensive services over time.

Even if you have third (or the highest) tier option at comparatively exorbitant price, you will be surprised to see there are takers for that that price point too.

However you will need to package you tier options correctly, clearly drawing distinction in the services you offer in each tier. Putting those service options together at price points that instill a sense of belonging in the prospective client’s mind.

4. Segmentation of Existing, Prospective Clients

With three-tiered pricing strategy, accounting firms can easily and pretty effectively segment their customer base.

You will be surprised to know how client segmentation can do wonders for your accounting practice. With a little review you will be able to determine

- Which clients need more personal assistance

- Who will appreciate and pay for high-value services

- % of customers opted for basic/ standard/ premium offer

- % of happy customers in each segment o problematic ones

This can bring clarity how you deliver high-value services, how you carry out marketing communication to each segment whether it is distinct or common.

What does that mean?

This clarity will allow you to focus your resources on clients with highest potential for growth and profitability. You can voluntarily churn set/segment of clients who are not fit for your or firm’s philosophy.

5. Simplified Decision-Making

Take a look at the example above.

Clients are able to make their decision at a glance. The subconscious comparison and upselling happens when they start analyzing each tiers, comparing between tiers.

Presenting clients with a simplified pricing structure makes it easier for them to make informed decisions. The tiered approach provides clear options and enables clients to choose the level of service that best meets their requirements. This simplification reduces decision-making complexity and improves the overall client experience.

With the three tiered pricing strategy, decision making is not only becomes simpler for your clients, it becomes easier for you too.

How?

- Determine ‘Right’ clients base for your firm

- Determine ‘Right’ resource mix to serve each client segment

- Service level

- Attention to details

More information is not always helpful. What is important is clarity you get from that information. More clarity helps you make appropriate decision.

That’s a double win for you.

6. Enhanced Client Perception

Remember I talked about Client’s Perspective at the beginning of this post. This is exactly what I was trying to put across to you.

Offering a three-tiered pricing structure positions your CPA and accounting firm as professionals who understand their clients’ diverse needs and budgets.

It demonstrates that your firm is flexible, adaptable, and focused on providing tailored solutions. This enhances the firm’s credibility and perception in the eyes of prospective clients, potentially leading to increased client trust and loyalty.

This leads to the next point about leveraging perception to your advantage.

7. Competitive Advantage

A three-tiered pricing strategy allows CPA and accounting firms to differentiate themselves from competitors. By offering multiple pricing options, firms can stand out in the market and showcase the unique value they provide at each tier. This differentiation can help firms attract clients who are looking for customized services and a range of options, giving them a competitive edge.

Remember, with the three options pricing you are making it easier for your clients to select right service option within service options you have provided; however making it hard compare with competitors offer puts you in an advantageous position. You have to make sure your service is not perceived as commodity that can be compared with other provider.

8. Improved Cash Flow

Traditionally, cash flow has been a challenge for accounting firm especially smaller ones. It is ironic, those who identify cashflow problems for others have to run into cashflow due to high account receivable.

A tiered pricing structure can help optimize cash flow for CPA and accounting firms. By offering different pricing tiers, firms can diversify their revenue streams and reduce dependence on a single pricing model. This allows for more consistent cash flow and financial stability, as revenue is generated across multiple tiers and clients.

By implementing tiered pricing strategy along with advance payment plus recurring payment option can put your accounting practice in growth mode.

As firms continue to grow and evolve, a three-tiered pricing structure provides room for expansion. Firms can introduce additional tiers or adjust existing tiers to accommodate changing market dynamics, client demands, and service offerings. This scalability ensures that the pricing structure remains relevant and aligned with the firm’s growth trajectory.

By adopting a three-tiered pricing structure in CPA proposal and CPA engagement letter accounting firms can unlock numerous benefits as explained above. This pricing strategy empowers firms to cater to a diverse client base while maximizing revenue potential and maintaining a strong market position.

0 Comments